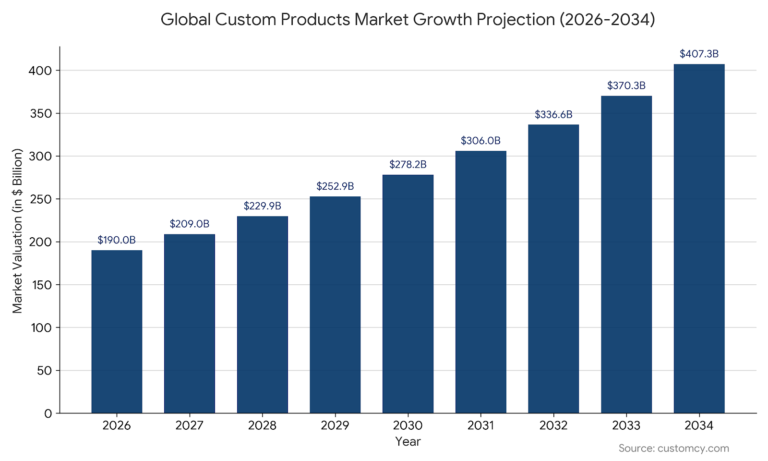

Customization is changing the way products are made and sold in 2025.

From fabrics and materials to modular designs and on-demand manufacturing, consumers seek uniqueness, brands aim for higher margins, and new technologies (AI, 3D printing, AR/VR) make it possible at scale.

If product customization is available, 59% of internet buyers are more likely to purchase from that brand. On the other hand, Mentions of “customization” in apparel industry filings doubled between 2017 and 2021, underscoring how strategic the shift has become. In this article, you’ll see the biggest customization trends for 2025 and beyond, shaping the future — plus data and takeaways to help you stay ahead.

Table of contents

- Mass-Batch Customization in Apparel

- Sustainable Made-to-Order Fashion

- IoT and Digital Twins in Smart Manufacturing

- AI-Driven Product Design

- AI-Driven Product Configurators

- B2B Custom Manufacturing Marketplaces

- Additive Manufacturing (3D Printing) for Custom Goods

- Customizable Furniture

- AR/VR Virtual Try-Ons and Custom Visualization

- Microfactories & On-Demand Production

- Modularity + Micro-Segmentation: Building the Product-of-One

- Smart & Custom Packaging: Turning Boxes into Brand Moments

- Custom Home Decor

- DTC Custom Retail Platforms

- 3D Body Scanning for Perfect Fit

- Automotive Customization & Bespoke Interiors

- User-Generated “Micro-Brands

- Consumer Co-Creation & DIY: Crowdsourcing Meets Home-Made Creativity

- Medical & Personalized Biotech: Custom Care and Patient-Specific Devices

- CPQ Maturity

- Edge Manufacturing & 5G-Enabled Customization

Mass-Batch Customization in Apparel

Mass-batch customization (MBC) blends mass production with many small variants. It’s emerging as brands offer limited runs of custom clothes. In fact, among Gen Z, 75% say they’re likelier to buy if a product can be customized. On-demand tools and flexible sewing lines let retailers produce 10,000 different T-shirt designs instead of a single style. This trend is rapidly emerging as digital technologies make it significantly easier to configure products online, and consumer demand for unique self-expression continues to surge.. North America commands ~40% of the global custom apparel market. Companies like Son of a Tailor (custom shirts), Customcy (custom dresses), and giants like Nike (Nike By You) let customers pick fabrics, cuts, even monograms.

This trend is driven by online design tools, automation in sewing/printing, and social media pushing individual style. A recent report projects the custom clothing market to reach $57.55 billion in 2024, increasing to approximately $146B by 2033, with a compound annual growth rate (CAGR) of around 11%. Online channels will already account for $70B by 2028, showing the category’s strong, sustained growth.

Consumers get unique wardrobes; brands can cut inventory waste. But logistical complexity and higher costs per piece remain challenges. As technology improves, by 2027, even fast-fashion could shift to made-to-order runs. Expect smarter supply chains and AI “fit consultants” to expand this.

Sustainable Made-to-Order Fashion

Sustainability is tied to customization. By making products only after orders arrive, waste plummets. In fashion, made-to-order brands report up to 60% less fabric waste compared to mass production. With 11.3M tons of textile dumped in US landfills in 2022, eco-conscious consumers and regulators are pushing for custom fits and local production. Nearly 45% of European custom-apparel consumers say sustainability influences their purchase..

Brands like Customcy (offering custom products made from wood, leather, marble, etc), Noize (custom jackets), and online marketplaces (Apposta for shirts) already operate on pre-order models. New fabric technologies (biodegradable textiles, 3D-knitting) let makers quickly switch designs for each order.

This trend is driven by environmental regulations, the “slow fashion” movement, and consumer willingness to pay a bit more for green custom products.

Bespoke clothing that fits better and uses less material benefits customers (no returns, perfect fit) and the planet. Challenges are speed and price: made-to-order often costs more than off-the-rack and takes longer to ship. Notably, 1 in 5 customers say they’d pay a 20% premium for custom goods, and 48% would wait longer for them.

By 2027 expected that virtual fashion shows to sell custom-run garments, and local “sewing studios” where consumers pick a design that’s stitched on-site. This trend will expand beyond apparel to things like custom wood decor (made with reclaimed wood) and home goods.

IoT and Digital Twins in Smart Manufacturing

Internet of Things (IoT) and digital twins are enabling extreme customization in factories. Machines and products come with sensors so production can adapt in real-time. For example, a digital twin of a car assembly line can automatically reconfigure robots for a custom build order.

This trend is driven by 5G connectivity and AI means data flows instantly between designs and machines. Autodesk’s Fusion 360 and Siemens’ IoT platforms let designers tweak a 3D model and see factory adjustments. Consumers may even co-design products via AR, with the factory adapting immediately.

This makes mass customization efficient – factories become flexible and self-optimizing. The challenge is cybersecurity and data management. In the late 2020s, we’ll see fully digital product passports: each item’s design and manufacturing specs are tracked, so customized products can be easily serviced or recycled. IoT-enabled supply chains will route materials based on live demand for custom orders, minimizing inventory and waste.

AI-Driven Product Design

Artificial intelligence is transforming product design by moving from automation to generative design—where AI creates optimized variations based on set parameters, exploring solutions human designers might overlook. This enables rapid prototyping, intricate geometries, and designs once impossible or too costly using traditional methods.

With AI and machine learning now able to process massive datasets in real time, generative design supports hyper-personalized products at scale. The AI market is set to grow from $244 B in 2025 to $2.4 T by 2032, with much of this investment fueling design democratization through low-code and no-code tools. Businesses from aerospace to apparel can now develop bespoke products faster, cheaper, and with less waste.

Real-world examples include Autodesk’s AI tools generating custom parts to exact performance needs, or consumer platforms letting shoppers co-create furniture, bikes, or jewelry with AI suggestions. Tools like Uizard turn sketches into polished interfaces, enabling instant digital prototyping.

By 2027-2030, expect AI to influence every stage of product development—from concept and material choice to production and delivery—driving “hyperautomation” where designs adapt dynamically to each user. This trend not only accelerates time-to-market but also expands what’s possible in e-commerce, B2B manufacturing, and on-demand retail customization.

AI-Driven Product Configurators

Artificial intelligence and cloud tools are powering next-gen configurators. Surveys show customization possibilities interest roughly 25–30% of online shoppers, a useful signal for configurator adoption. Shoppers can now customize products in real-time with AI-assisted design suggestions. For example, online furniture stores let you mix-and-match modules and see photorealistic renders instantly. The product configurator software market is growing fast: $1.1B in 2024, forecast to reach $3.3B by 2031 (CAGR ~7.8%).

This trend is driven by AI/ML algorithms, cloud 3D rendering, and IoT connectivity. Brands like Dell and HP have long offered custom PCs; now, even complex goods (bicycles, furniture, jewelry) have AI configurators. BIM (building information modeling) lets homebuyers lay out custom houses. Startups like Configify and Threekit provide turnkey tools so any brand can embed a configurator.

Clothing brand Ministry of Supply uses AI to recommend custom cuts. Car companies use AR configurators to let buyers tweak features. In manufacturing, Komatsu has an AR configurator for custom heavy equipment.

These tools empower non-experts to customize products, boosting sales. Challenges include needing 3D models for all parts and complexity in price quoting. In the next 5 years, expect low-code configurator platforms so every DTC and industrial brand can launch custom options rapidly.

B2B Custom Manufacturing Marketplaces

For businesses needing custom parts, online platforms are booming. Xometry, Customcy, Protolabs, and other “Uber for manufacturing” services like Customcy match companies to suppliers and artisans for CNC machining, injection molding, 3D printing, and custom handmade products. Customcy alone offers a range of manufacturing processes and materials on demand, letting businesses and engineers design bespoke components without setting up a factory.

This trend is driven by Industrial IoT, cloud quoting tools, and pandemic-era supply-chain flexibility. Companies can upload CAD files and get instant quotes or white-label parts. Platforms ensure quality by vetting suppliers and handling logistics.

For example, A nutrition-focused startup wanted marble dumbbells and kettlebells embossed with their logo as premium promotional gifts. They turned to Customcy, which sourced the marble, CNC-milled and handcrafted each piece, and managed custom engraving—delivering ready-to-ship sets without any in-house tooling.

In another case, an online retailer needed elegant custom wooden boxes and leather tote bags: Customcy produced bespoke wooden boxes engraved with the seller’s custom text, enabling them to sell a polished, branded unboxing experience through their online and Etsy shops.

Small and mid-sized businesses now get large-scale custom manufacturing like big OEMs. It democratizes production: even hobbyists can order metal parts cheaply. Challenges include data security and building trust in distributed networks. By 2027, expect these marketplaces to add AI that optimizes designs for manufacturing, automatically suggesting tweaks to save cost or time, further smoothing custom supply chains.

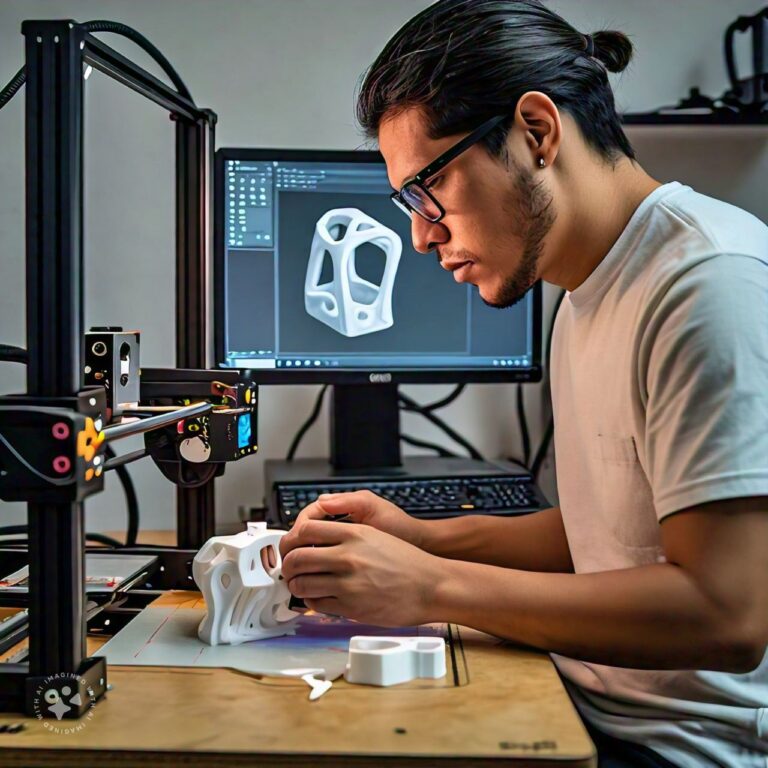

Additive Manufacturing (3D Printing) for Custom Goods

3D printing—aka additive manufacturing—has moved from prototyping toy parts to powering real, on-demand customization across industries. Roughly 41% of manufacturers believe 3D printing capacity for mass customization is crucial to their strategy. It removes the need for costly molds, so producing a single unique item can be nearly as affordable as producing many different ones. The market is booming – from about $19.3B in 2024 to ~$101.7 by 2032 (CAGR ~23.4%).

Today’s printers handle metals, plastics, ceramics, and engineered composites, and “print farms” (small, clustered production cells) act like microfactories that switch designs in minutes. That’s why you’re seeing custom jewelry, eyewear, shoes, prosthetics, and even aerospace parts made to order—examples range from HP’s Multi Jet Fusion custom sneakers to medical prosthetics and NASA-printed components. Platforms like Shapeways let designers sell directly, while OEMs use printed parts for interiors and low-volume runs. Protolabs reports 70% of engineers saw more custom parts printed in 2023 than in 2022—clear evidence AM is moving into production use

3D printing shortens lead times, slashes prototyping costs, and opens “economies of scope” where variety—not volume—drives value. Limits remain: print speed, certification for critical parts, and material performance. Expect the next wave (2027–2030) to bring multi-axis machines, multi-material heads, and tighter AI-driven process control—so customized, high-performance parts become routine for e-commerce, B2B supply chains, and Etsy-style makers alike.

Customizable Furniture

Customizable furniture lets consumers choose exact dimensions, materials, colors, and features — creating pieces that fit their space and style perfectly. In 2023 furniture category made the highest share of all categories (25.15%) of custom-made products sold online, followed closely by luggage and bags. Customizable furniture is especially appealing in smaller urban homes where every inch matters, and in an era where consumers want furniture to be both functional and personal.

The customized furniture market is projected to hit $89.94 by 2030 at a 10.73% CAGR, while the smart furniture segment is growing even faster at 14.5% CAGR. Drivers include demand for multifunctional units with built-in storage, smart lighting, ergonomic designs, and tech integrations like wireless charging or IoT connectivity.

Major brands are leaning in. IKEA, for example, now uses AR tools so shoppers can visualize custom pieces at home. Living room sectionals come with bespoke upholstery and charging ports. Kitchens are shifting toward modular islands and tailored storage.

The payoff? Consumers get space-optimized, comfort-enhancing pieces that reflect their individuality. For brands, customization enables premium pricing and deeper engagement — though it requires managing complex supply chains and tech integration.

By 2027–2030, expect AI-driven adaptive furniture that automatically adjusts height, temperature, or lighting, plus AR visualization as a standard part of the buying process.

AR/VR Virtual Try-Ons and Custom Visualization

Augmented reality (AR) and virtual reality (VR) are becoming essential for product customization. Shoppers can “try on” products or place virtual models in their space. The retail industry is rapidly adopting AR: 61% of shoppers prefer retailers that offer AR experiences, and AR in retail is set to be a $12B market by 2025.

Online furniture stores (IKEA, Wayfair) let you drop a 3D model of a sofa in your living room via your phone camera. Clothing and eyewear brands (Warby Parker, L’Oréal) offer AR apps to see clothes, glasses, or makeup on your photo. These tools often integrate customization: change colors, fabrics, accessories, and see the result live.

Better smartphone cameras, cheap AR toolkits, and consumer comfort with AR (thanks to games like Pokémon Go) are key drivers for AR/VR Virtual Try-Ons. Brands like Gucci and Nike use AR in apps for custom shoe previews. In VR, car dealers give buyers a virtual showroom to customize paint and trim.

AR/VR bridges the gap between online and in-store customization. It raises confidence (fewer returns) and engages customers deeply. Tech and cost barriers remain (e.g., creating 3D models for every product). By 2027, many DTC brands will have built-in AR configurators; early adopters see 15–20% lifts in conversion from AR-enabled customization.

Microfactories & On-Demand Production

Microfactories – small, highly automated plants – are rising as a new manufacturing model. They use robotics, AI, and IoT to make batches of custom goods closer to customers. Unlike huge factories, a microfactory can quickly switch between products. The World Economic Forum notes microfactories can cut energy use by ~80% and water by ~90% compared to traditional plants. Companies adopting customization practices also report up to 62% cost reductions from decreased production downtime. For example, EV startup Arrival built modular microfactories for ~$50M each (vs $1B for a conventional auto plant).

Industry 4.0 technologies, reshoring trends, and demand for local, on-demand goods for key drivers for microfactories & on-demand production. Brands like Rothy’s (shoes made from plastic bottles) and Customcy (custom product manufacturing) have pilot microfactories.

Microfactories let manufacturers offer mass customization profitably. Consumers get faster, locale-tailored products (e.g., snacks packaged for local festivals). The main hurdles are up-front investment and digital integration. By 2030, we’ll see networks of small factories linked via smart supply chains. These micro-centers could produce custom electronics, home decor, dresses, leather goods, bikes, or nutrition blends on demand, making supply truly agile and sustainable.

Modularity + Micro-Segmentation: Building the Product-of-One

Modularity (swap-in parts, upgrade kits) plus micro-segmentation (AI-driven, ultra-granular customer slices) is the next step in customization: design interchangeable building blocks that can be configured for tiny audience segments — down to the individual. Drivers include cheaper sensors and telemetry, advances in AI/ML for customer micro-profiles, and manufacturing flexibility (3D printing, modular assembly lines).

ReaFairphone and modular PCs let users swap cameras or batteries; IKEA-style configurable furniture and e-bikes use standard interfaces to mix parts; Lego and maker kits power DIY upgrades. On the micro-segmentation side, lessons from cybersecurity and real-time analytics show how systems can enforce strict boundaries and tailor features to precise usage patterns. Combine them and you can offer, say, a wearable with swappable sensor modules matched to a runner’s gait data, or a sofa whose firmness modules are selected by household micro-preferences.

Benefits: longer product lifespans, lower waste, premium pricing, and highly relevant feature bundles. Friction points are many-SKU complexity, standard-interface governance, and supply-chain orchestration.

By 2027–2030, expect AI to map micro-segments to modular catalogs and flexible factories to assemble bespoke builds on demand — effectively making “mass customization” operate at the scale of one.

Smart & Custom Packaging: Turning Boxes into Brand Moments

Packaging is no longer just protection — it’s a direct channel for brand expression. Digital and short-run printing let DTC brands create bespoke boxes, tissue, and labels at scale, and the personalized packaging market (~$38.4B in 2024) is growing fast (to ~$66.8B by 2034, 5.7% CAGR). North America alone is about $15B today. Companies like Packlane and The Custom Boxes make low-MOQ runs accessible, while Nike’s AR-enabled shoe boxes show how packaging can bridge physical product and digital experience.

E-commerce fuels the trend: shoppers share unboxing on social media, so unique packaging drives word-of-mouth and repeat purchases. Tech—RFID, QR codes, and embedded AR—turns every parcel into a dynamic touchpoint that can deliver personalized content, authentication, or cross-sell offers. Sustainability is a major motivator: brands prefer recyclable substrates and on-demand prints to avoid excess inventory.

Operationally, customization raises SKU complexity and cost. The solution is dynamic printing at fulfillment nodes: integrated printers in distribution centers could print labels and sleeves per order, enabling thousands of packaging variants without huge stocks. By 2027–2030, expect interactive, sustainable packaging—smart codes, AR storytelling, and closed-loop materials—that make the unboxing itself a bespoke product experience.

Custom Home Decor

Custom home decor is about making living spaces feel personal — not copy-paste. Instead of mass-produced pieces, shoppers want items that tell a story: a lamp shaped for a specific corner, drawer pulls engraved with family initials, or wall art made from a scanned childhood postcard. The U.S. home decor market is large — roughly USD 33.51 billion in 2025, rising at by CAGR of 2.11 by 2030 — and a growing slice of that demand is for bespoke goods.

Two forces are pushing this trend. First, people seek authenticity and emotional value in their homes. Second, health and safety worries (for example, concerns about PFAS in some mass-market items) make shoppers prefer transparent, small-batch production they can trust. Technologies like 3D printing and on-demand short runs let makers produce one-off or small-batch pieces affordably, while marketplaces (Etsy, specialty DTC shops) let artisans reach buyers worldwide.

Examples range from 3D-printed lamps and pet-shaped bookends to framed handwritten notes and custom-printed textiles. For sellers, custom decor builds stronger customer bonds and supports premium prices. It also raises operational questions: how to scale one-offs, source varied safe materials, and keep costs reasonable. By 2027–2030, expect smarter AI design tools, faster multi-material printers, and smart-home integrations that let decor adapt its look and feel to mood — making personalized homes easier and more affordable than ever.

DTC Custom Retail Platforms

Direct-to-consumer (DTC) e-commerce platforms are fueling customization. Shopify, WooCommerce, and marketplaces (Etsy, Alibaba’s custom trade) now offer built-in options for custom products. A 2025 survey notes 65% of custom apparel sales happen online. Tools like Shopify’s 3D product setup or Zazzle’s print-on-demand empower small brands to offer personalization easily.

Printful and Printify integrate with shops to print custom shirts, mugs, or posters when ordered. Custom jewelry brands like Customcy let you design pendants on their website. Major retailers also opened DTC custom sites (e.g., Nike Run Club allows ordering shoes with custom colorways).

This trend is driven by lower barriers for small creators, and consumer desire for one-off gifts (e.g., photo mugs, custom phone cases).In practice, about 62% of online shoppers report they’ve bought from or advocated for a company offering personalized products or services. Print-on-demand (POD) removes inventory risk: if nobody orders your unicorn T-shirt, you don’t pay for a batch.

Small businesses and artisans can compete with big brands via personalization. It empowers niche markets (custom gaming gear, vegan leather goods) and local craftspeople selling globally. Challenges include quality control and brand consistency. The future is digital factories and “dark stores” that fulfill customized e-commerce orders in minutes. By 2030, many DTC brands will rely solely on on-demand manufacturing, never holding stock.

3D Body Scanning for Perfect Fit

Advances in 3D body scanning tech let manufacturers tailor fit precisely. Retailers and made-to-measure services (like Customcy and Sewbo) use phone cameras or kiosks to scan bodies and recommend sizes or patterns. According to industry data, over 2,500 European fashion retailers will have adopted body scanning by 2023, boosting customer satisfaction by ~40%.

This trend is driven by improved scanners (e.g., Kinect, LiDAR on phones) and AI pattern generators. In apparel, brands use it to reduce returns (poor fit) and to offer a “fit guarantee”. In shoes, brands like Customcy can print custom insoles from scans. Eyewear companies scan faces for ideal lens shape.

This trend is impacausingppers to get garments that fit uniquely, reducing waste from returns. Retailers cut costs on returns/refunds. Barriers include privacy concerns and the need for standards. In the next 5 years, expect scanning combined with AR – you will virtually try on a dress that’s digitally tailored to your dimensions. Physical tailoring shops may integrate scanners to accelerate custom orders.

Automotive Customization & Bespoke Interiors

Carmakers now offer far more than paint colors: buyers can configure upholstery, wheels, tech packs, and in-cabin experiences through online configurators and VR showrooms. 84% of prospective Chinese luxury-car buyers rate the option to customize as important ,highlighting strong regional demand for automotive customization. The automotive customization software market was about $1.2B in 2024, forecast to reach $2.5B by 2033 (CAGR ~9%). At the same time, the broader automotive interior market is expanding—expected to hit roughly $205.B by 2032—as interiors become a key differentiation point.

Aftermarket and tech firms (Jetson, Unplugged Performance) sell plug-and-play modules to add smart features; 3D printing and digital trim providers enable custom body parts and one-off interior pieces. Dealers are shifting into experience centers where customers “try-before-they-buy” in VR. Luxury brands (BMW, Tesla) already let buyers preview highly personalized cabins online or via AR.

As cars move toward software-defined and autonomous platforms, the cabin becomes a “third space” — a mobile living or working area that owners want tailored to comfort, connectivity, and style. Expect over-the-air personalization (UI themes, subscription features), AI/IoT-driven seat and lighting profiles, and digital twins for virtual prototyping.

Too many options can slow decisions and require flexible manufacturing and robust cybersecurity. By 2027–2030, customization will be tightly integrated with software updates and local microfactories, making bespoke interiors faster, safer, and more common.

User-Generated “Micro-Brands

Technology is enabling anyone to become a product designer and launch their own business, without the traditional barriers of manufacturing or logistics. With easy-to-use design tools and on-demand production platforms like Customcy, a creative individual can bring an idea to life—whether it’s apparel, jewelry, home décor, shoes, or even a niche handicraft—while a service handles manufacturing, fulfillment, and shipping. This model eliminates the need for production and allows creators to focus entirely on design, marketing, and community building.

The rise of e-commerce platforms like Shopify, Etsy, Customcy, and the growth of print-on-demand services such as Printful and Teemill have fueled this shift. Search interest for “print on demand” has surged in recent years, reflecting its expanding adoption. Even in the realm of custom handmade products and handicrafts, the model has evolved. Skilled artisans can now produce unique, high-quality goods tailored to buyer preferences, leveraging global marketplaces to reach customers directly. This blends traditional craftsmanship with modern commerce, offering buyers authenticity and creators global exposure.

The result is a more diverse and vibrant product landscape, filled with unique items that reflect personal taste and creativity. No surprise: roughly 50% of customers say customized products make great gifts, fueling seasonal and occasion-driven demand. However, this democratization also creates a crowded marketplace where standing out requires more than just a great product—it demands a clear brand identity, storytelling, and a loyal audience. Those who master these elements can transform a side passion into a sustainable, global micro-brand.

Consumer Co-Creation & DIY: Crowdsourcing Meets Home-Made Creativity

Brands are no longer the only designers — customers are co-creating products both on platforms and at home. Crowdsourcing sites and brand contests (Threadless, LEGO Ideas, Muji) let fans submit designs that can win production and reach a global audience. At the same time, the DIY movement — amplified by TikTok trends, printable templates, and affordable tools like laser engravers and at-home kit builders — turns kitchens and garages into micro design studios.

Social media makes ideas contagious, marketplaces scale niche demand, and low-cost maker tools let anyone produce professional-looking goods. That combination reduces product risk for brands (only popular designs move to production) while giving consumers meaningful, story-rich items they’re proud to own and share. LEGO frequently brings fan sets to market via Ideas; Nike’s “Nike By You” invites customers to design sneakers; and countless Etsy sellers sell templates, kits, and finished goods born from community creativity.

Co-creation drives loyalty, creates active communities, and supports premium pricing for highly personal items. It also introduces friction: IP ownership can be messy, quality varies across user contributions, and brands must build workflows to turn diverse inputs into scalable, reliable products. Looking ahead to 2027–2030, expect AI-guided design assistants to help users create viable products, tighter pipelines from crowdsourced concepts to on-demand factories, and hybrid platforms that manage IP, quality control, and fulfillment — further blurring the line between consumer and creator.

Medical & Personalized Biotech: Custom Care and Patient-Specific Devices

Healthcare is rapidly shifting from “one-size-fits-most” to truly custom care. On the device side, 3D printing produces patient-specific 3d printed implants, prosthetics, and surgical models—helping hospitals stock fewer generic parts and deliver better-fitting solutions. The 3D-printing healthcare segment is forecast to jump from $1.96B in 2025 to $8.71B by 2034 (CAGR ≈18%), underlining rapid clinical adoption. The 3D-printing healthcare segment is projected to grow from $1.96B (2025) to $8.71B (2034) (CAGR ~18%). On the therapeutics side, personalized medicine—driven by genomics, AI, and biomarker data—is reshaping treatments; the broader personalized medicine market is forecast to reach ~$870B by 2030 (CAGR ~8.5%).

Real-world work is already underway: 3D Systems and Organovo print custom implants and tissue scaffolds; digital pharmacies and telemedicine pilots aim to deliver bespoke dosages; AI helps match drugs to molecular profiles. The payoff is clear: optimized performance, lower trial-and-error, and better outcomes for patients.

Barriers remain—regulatory pathways, production cost for single-batch therapies, data privacy, and clinical validation. Still, by 2027–2030, expect tighter integration of bioprinting, AI-driven treatment planning, labs-on-chips, and on-demand manufacturing of meds and devices. The result: healthcare where the product is built around a person’s biology, not the other way round.

CPQ Maturity

B2B customization is moving far beyond “pick a color” and into the realm of complex, multi-component builds—where one wrong configuration could cost thousands. This is where advanced product configurators tied to CPQ (Configure–Price–Quote) and ERP systems are becoming essential. Gartner and Forrester data both show accelerating CPQ adoption as industrial sellers race to offer guided, self-service tools for complex ordering.

Think of heavy machinery manufacturers letting buyers spec every engine, attachment, and control system through an intuitive online interface—instantly generating accurate pricing, lead times, and CAD models. Or telecom hardware suppliers bundling enterprise routers, switches, and service plans into a single, validated quote.

Edge Manufacturing & 5G-Enabled Customization

5G and edge computing are reshaping how factories handle customized production. By processing data closer to the source, edge computing removes the delays of traditional cloud workflows. Combined with 5G’s ultra-low latency, manufacturers can coordinate flexible production lines, run remote CAD-to-machine operations, and adapt designs in real time. This is a critical enabler for Industry 4.0, where smart factories dynamically adjust output without lengthy reprogramming or downtime.

In practice, this means a customer’s design change can be processed, validated, and sent directly to machines within seconds. For sectors like automotive, aerospace, and consumer electronics, the ability to make near-instant adjustments to small batch orders or prototypes can drastically reduce lead times and waste.

As adoption grows, we’ll see 5G-enabled edge systems integrating with MES, ERP, and digital twin platforms to create closed-loop manufacturing ecosystems. The result will be real-time customization at scale—factories that respond to market shifts as quickly as e-commerce sites update product listings. Over the next decade, this combination of 5G and edge computing is set to move custom manufacturing from days or weeks of turnaround to near-immediate fulfillment.

Customization will be the new normal soon. Products will be conceived with configurability in mind from day one, and consumers will expect a “create-your-own” option on everything from sneakers to smartphones. This shift means the decade ahead will see an unprecedented fusion of digital and physical design, empowering buyers and reducing waste. The most successful brands will be those that embrace personalization technologies and sustainability hand-in-hand, leading the next revolution in consumer products.