We analyzed 13 million e-commerce stores to gain insight into the industry’s evolution in 2026.

Specifically, we looked at product categories, location, social media platforms, monthly sales, and more.

Using data from Storeleads, we uncovered some very interesting findings.

Now it’s time to share what we found.

Here is a Summary of Our Key Findings:

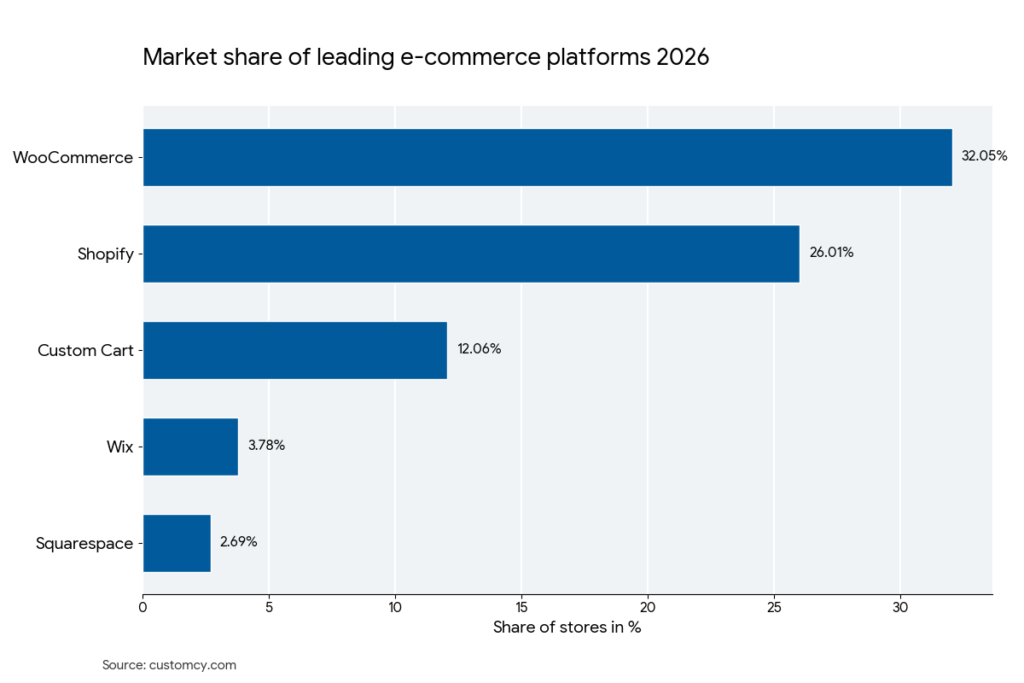

- Shopify and WooCommerce control 58.06% of the e-commerce market.

- A record-breaking 1.18 million new e-commerce stores launched globally in Q4 2025 alone.

- Nearly 90% of online stores report estimated monthly sales under $50,000.

- Small, niche catalogs are common in e-commerce, with one in three stores selling fewer than 10 products.

- Fashion remains the dominant industry sector, with apparel accounting for 13.91% of the global ecommerce market.

- Instagram is the top social platform, used by 38.85% of stores to reach customers.

- Direct communication is still the standard, as 47.74% of stores prioritize email for customer contact.

- The United States remains the central hub for digital retail, hosting 22.85% of all global stores.

- Low-inventory business models like dropshipping and print-on-demand now power over 7% of the entire ecommerce market.

- Trust in traditional naming remains high, with 55.15% of stores opting for a .com domain.

- A Contact Page is now the ultimate trust signal appearing on 56.80% of 2026 storefronts, as shoppers prioritize direct accessibility.

- Cloudflare is the leading security/performance tool, used by 42.19% of stores.

- Etsy (63,413 stores) and Amazon (31,614 stores) rank as the most popular secondary marketplaces among sellers, based on detected multi-channel usage in our dataset.

- Over 5% of e-commerce stores are currently password-protected.

- Judge.me dominates the Shopify App Store with an 18.58% usage rate, making it the #1 choice for building customer trust.

- USPS holds the largest footprint among global shipping carriers, used by 7.81% of Shopify stores worldwide.

- English remains the dominant site language, used by 56.3% of stores.

- The Americas remain the global leader, accounting for 32% of all e-commerce stores across North, Central, and South America.

- One in five Shopify merchants now utilizes the Trademark theme (19.5%), signaling a massive shift toward premium, feature-rich storefronts.

Shopify and WooCommerce Control 58.06% of the E-commerce Market

The world of online shopping is mostly a race between two big names. WooCommerce is the current champion. It runs 32.05% of the market with over 4.4 million stores. Many people choose it because it is flexible and lets them design their site exactly how they want.

Shopify is right behind them. It powers 26.01% of all online shops, which is about 3.6 million stores. While WooCommerce has more users, Shopify is growing very fast because it is easy to use and helps people start selling quickly.

Surprisingly, the third most popular choice isn’t a famous brand at all. About 12.06% of store owners, or 1.6 million people, use a Custom Cart.

Key Takeaway: While WooCommerce and Shopify power 58% of the market, the rise of Custom Carts shows that top brands now prefer unique websites over basic templates.

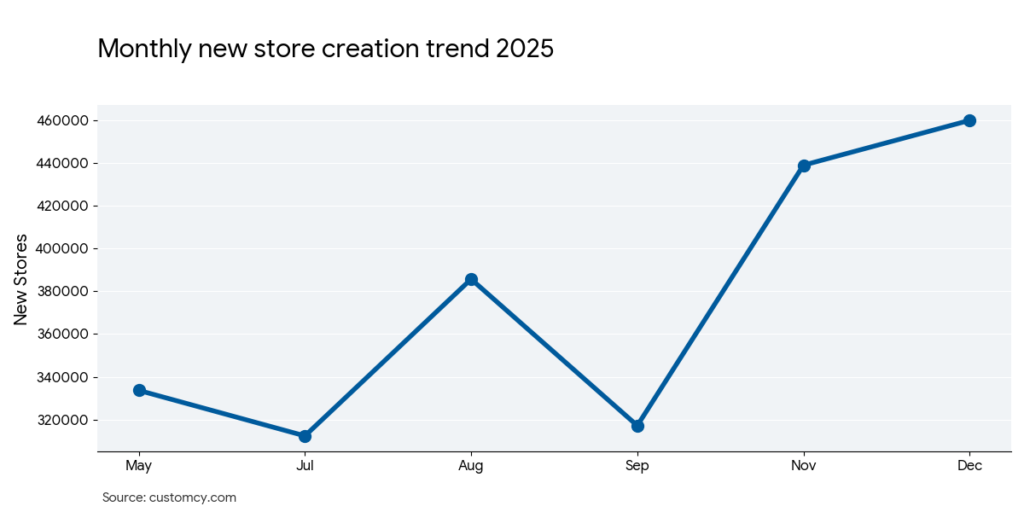

A Record-Breaking 1.18 Million New E-commerce Stores Launched Globally in Q4 2025

In 2025 Q4, the market hit a historic milestone: 1,182,288 new active launches. This is the first time the industry has cleared 1 million stores in a single quarter.

Compare that to 2017, when the average was just 60,000 stores per quarter. The acceleration is staggering.

Key Takeaway: The Q4 2025 milestone of 1.18 million new stores proves that the digital barrier to entry has effectively vanished.

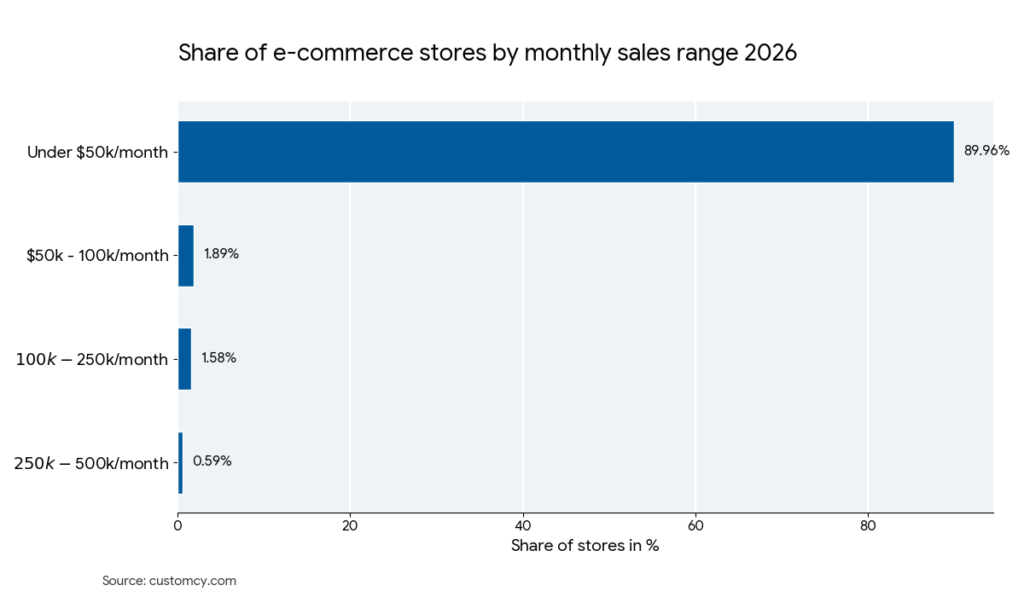

Nearly 90% of Online Stores Generate Estimated Monthly Sales Under $50,000

How much does a “typical” online store actually bring in?

Our research reveals that the e-commerce world is shaped like a pyramid. At the wide base, a massive 89.96% of all stores earn less than $50,000 in monthly sales.

The reality? Most stores are small operations, often run as side hustles or new startups just beginning to find their audience.

As you move up, the numbers drop off sharply:

- The Six-Figure Mark: Only 1.58% of stores reach between $100,000 and $250,000 per month.

- The Global Giants: Rarest of all are the “big players”—just 0.03% of stores analyzed make more than $5 million monthly.

While starting a store is easier than ever, scaling to the top tier remains a massive challenge. If your sales are currently low, remember: you’re in the same position as nearly 90% of the market.

Key Takeaway: The industry is primarily composed of small businesses. Success at the highest level is extremely rare and reserved for the largest global brands.

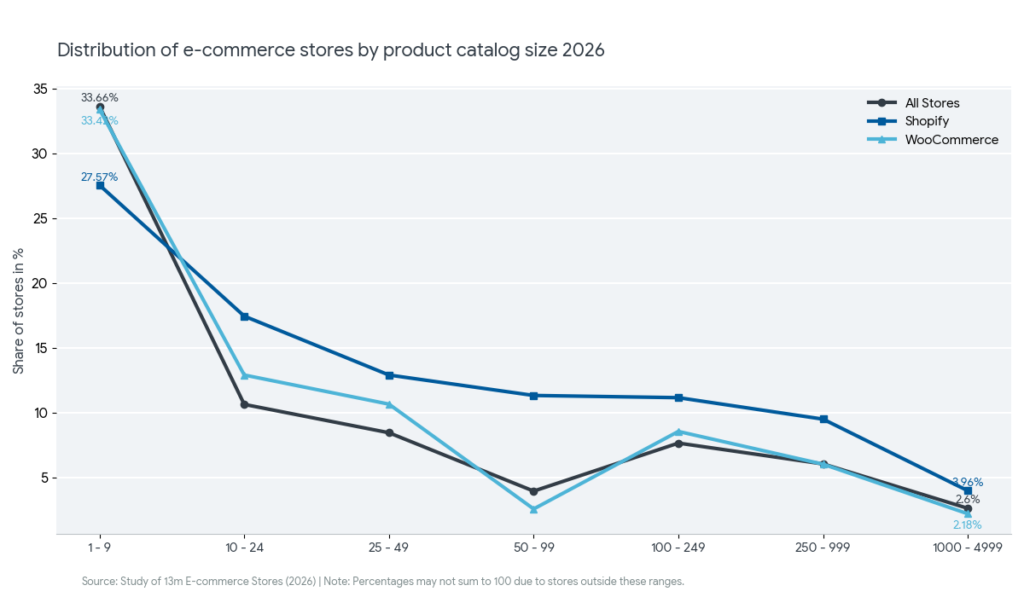

One in Three E-commerce Stores Operate With Fewer Than 10 Products

Think you need a massive catalog to start an online store?

Think again.

Our data reveals that 33.66% of all e-commerce stores sell between 1 and 9 products. These “micro-merchants” are now the biggest group in the industry. This is largely driven by the rise of dropshipping and specialized “one-product” brands.

Here is how the platforms stack up for small inventories:

- WooCommerce: 33.42% of its stores sell 1–9 items.

- Shopify: 27.57% of its stores sell 1–9 items.

Interestingly, Shopify becomes more popular as stores grow. For catalogs of 50–99 products, Shopify holds over 11% of the market, while WooCommerce has only 2.55%. This suggests that when it is time to scale, many owners find Shopify’s system more manageable for larger inventories.

Key Takeaway: Small stores are the heart of e-commerce. You do not need a huge inventory to launch, but if you plan to scale into hundreds of items, Shopify is the preferred choice for larger catalogs.

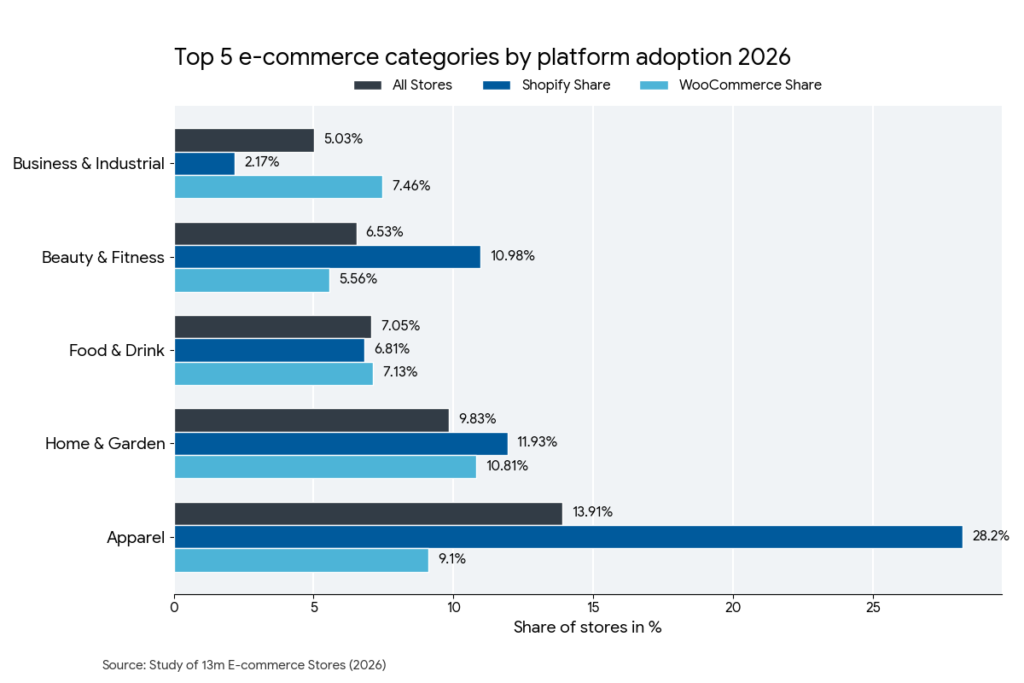

Apparel Remains the Dominant E-commerce Category, Representing 13.91% of All Stores.

What are people actually selling in 2026?

The data is clear: Fashion is king.

Apparel is the top category, making up 13.91% of all e-commerce stores. But when we look at specific platforms, the results are even more dramatic.

Shopify is the undisputed home of fashion. A massive 28.20% of its stores are in the Apparel category. Compare that to WooCommerce, where only 9.10% of merchants sell clothing. Shopify also leads in Beauty & Fitness (10.98%), likely because these products thrive on visual platforms like Instagram.

However, WooCommerce wins in the “functional” sectors:

- Home & Garden: 10.81%

- Business & Industrial: 7.46%

- Jobs & Education: 3.93%

This suggests that service providers and industrial sellers value the open-source flexibility of WooCommerce over the “polished” storefront style of Shopify.

Key Takeaway: If you are building a clothing or beauty brand, Shopify is the industry standard. For home goods, industrial tools, or educational services, WooCommerce is the preferred choice.

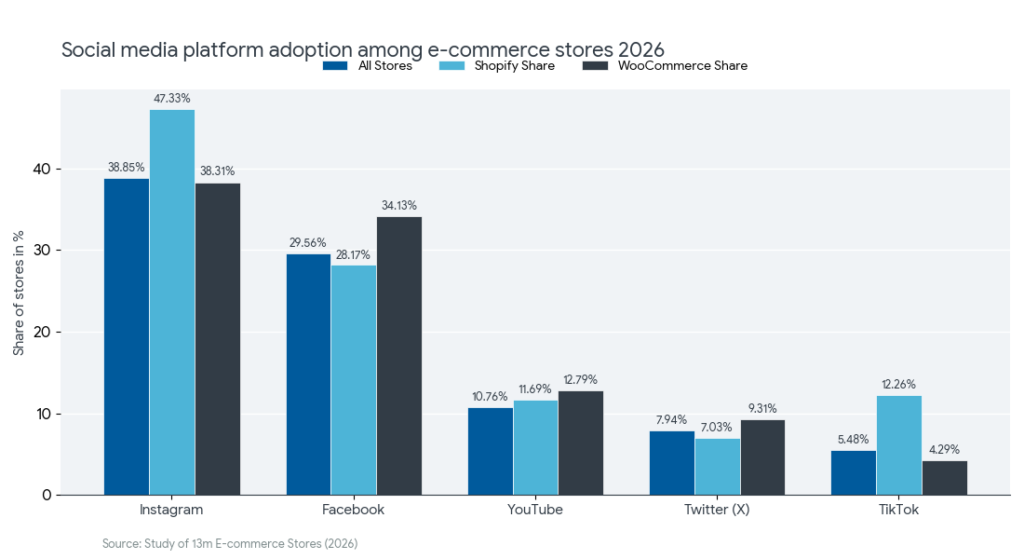

Instagram is the Leading Social Platform, Used by 38.85% of E-commerce Stores

Where do e-commerce brands actually find their customers?

The answer is simple: Instagram.

Our data shows that 38.85% of all stores use Instagram to connect with buyers. It’s the undisputed king of e-commerce social media.

But here’s the interesting part: The platform you choose changes your social strategy.

Check out how the “Big Two” compare:

- Shopify merchants are visual-obsessed. 47.33% are on Instagram, and they are much more likely to use TikTok (12.26%) than the average store.

- WooCommerce merchants focus on community. They lean heavily into Facebook (34.13%) and WhatsApp (7.40%).

The Top 3 Social Apps for Stores:

- Instagram (38.85%)

- Facebook (29.56%)

- YouTube (10.76%)

Key Takeaway: If your products look amazing in photos and videos, Shopify is your home. If you rely on direct chats and community groups, WooCommerce is the winner.

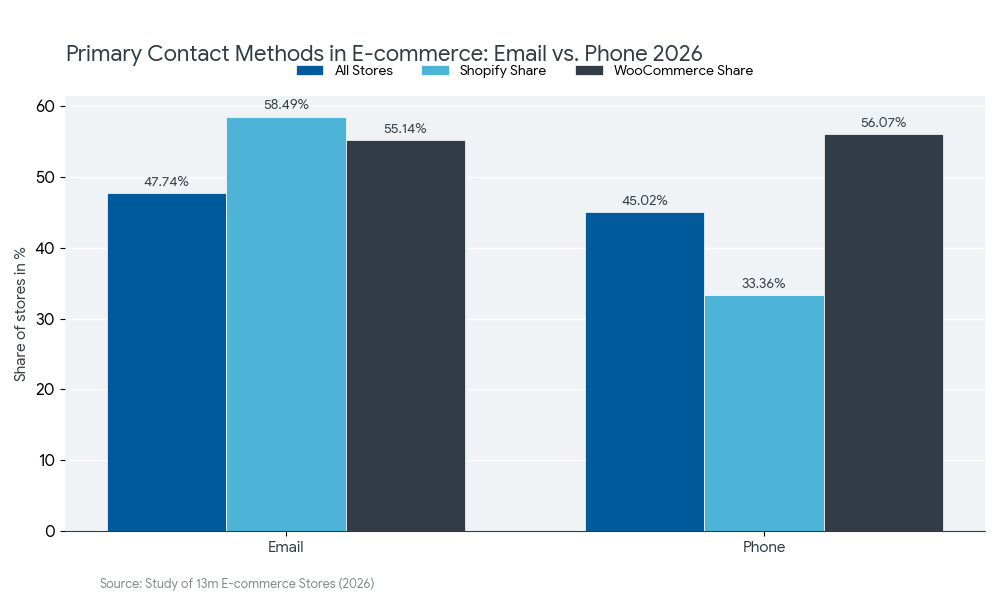

Direct Communication Is Still the Standard, as 47.74% of Stores Prioritize Email for Customer Contact.

How do online stores talk to their customers?

Most choose the inbox.

Our data shows that 47.74% of all e-commerce stores use email as their primary contact method. It is the “gold standard” for customer support.

But platforms have very different “personalities” when it comes to support:

- Shopify merchants love organization. 58.49% use email, but only 33.36% offer phone support.

- WooCommerce merchants prefer the personal touch. While 55.14% use email, over 56% provide a phone number.

Key Takeaway: Shopify users favor automated, digital communication. WooCommerce users stick to traditional, direct conversations. Either way, giving shoppers a clear way to get help is a top priority for 2026’s most successful brands.

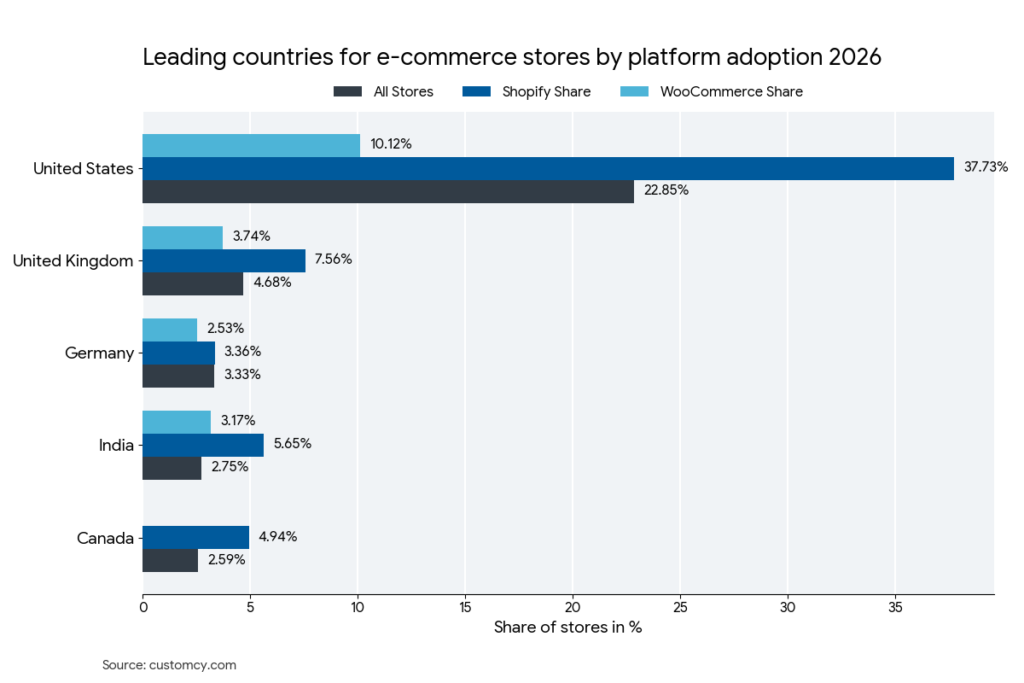

The United States Remains the Global Hub for E-commerce, Hosting 22.85% of All Stores.

Where is the world’s e-commerce capital? The data points to one clear winner: the United States.

Our research confirms that 22.85% of all online stores are based in the US. This makes it the undisputed global leader in digital retail. But here is the catch—success isn’t spread evenly. It’s concentrated in specific “power zones.”

In the US, California (1.71%) and Florida (0.98%) lead the pack. Internationally, England is the standout player, holding 1.95% of all global stores.

Shopify remains the top choice for North American hubs like California and Ontario. Meanwhile, WooCommerce maintains a more balanced, international presence across a wider variety of provinces.

Key Takeaway: Success is clustered in hubs like California and London. Shopify dominates these high-growth zones, while WooCommerce offers a more spread-out international footprint.

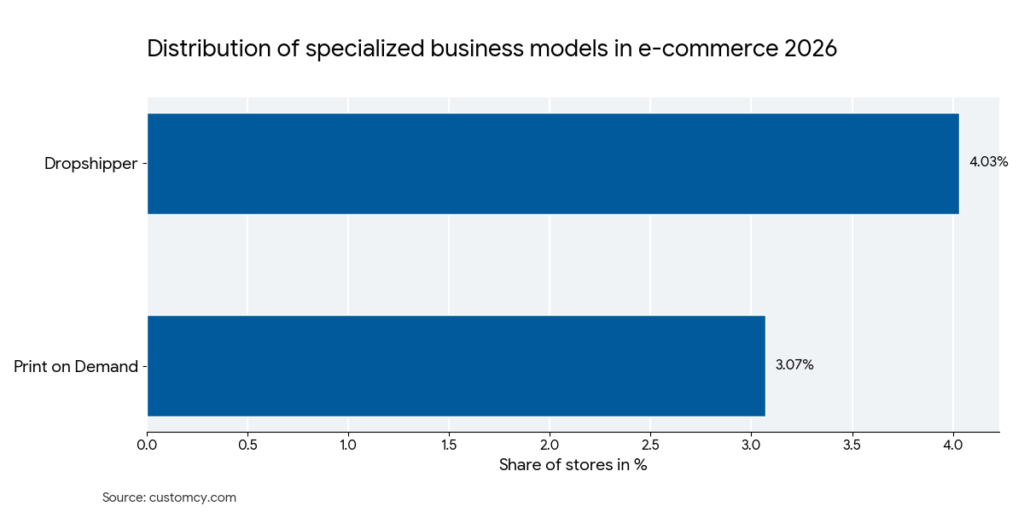

Low-Inventory Business Models Like Dropshipping and Print-on-Demand Now Power Over 7% of the Entire E-commerce Market

Want to start a store without ever touching a product?

You aren’t alone. “Inventory-free” business models have become a cornerstone of modern e-commerce. Our research shows that Dropshipping and print-on-demand (POD) now power 7.10% of all online stores.

These models allow entrepreneurs to bypass the warehouse and go straight to selling:

- Dropshipping (4.03%): Used by over 550,000 stores. It is the go-to for those selling existing products like electronics or gadgets. You list the item, and the supplier ships it. Simple.

- Print on Demand (3.07%): The choice for creators and artists. Products like t-shirts or mugs are only manufactured after a customer orders them, featuring your own unique designs.

Both models are exploding in popularity because they remove the biggest barrier to entry: the cost of stock. In 2026, the risk of starting a global brand has never been lower.

Key Takeaway: Dropshipping is ideal for scaling quickly with existing high-demand items. Print on Demand is the winner for artists building a brand around original designs. Both allow you to run a global business from a laptop.

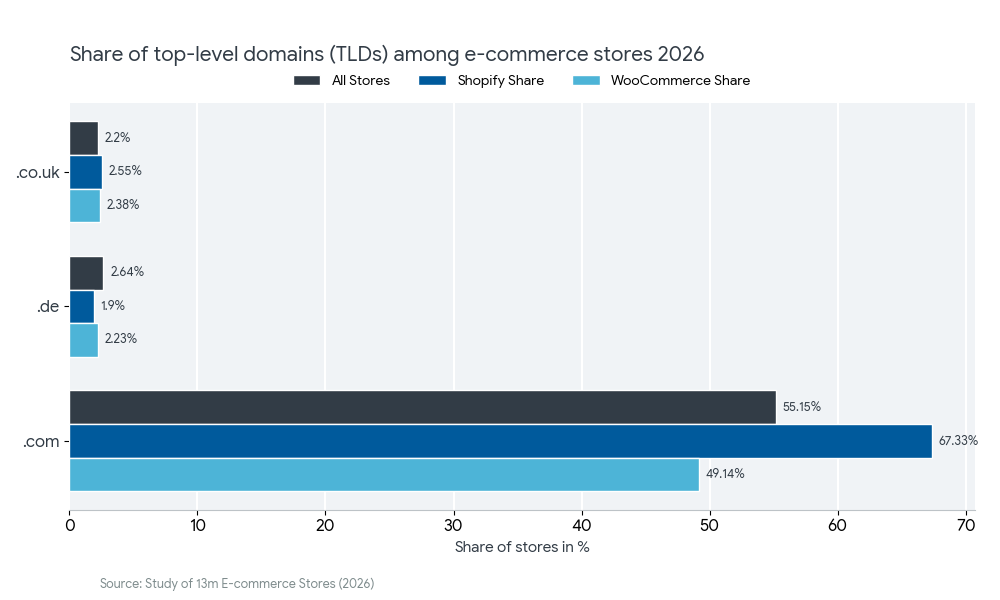

Trust in traditional naming remains high, with 55.15% of stores opting for a .com domain

Is the classic “.com” still the best choice for a new store?

According to the data, the answer is a resounding yes.

Our research shows that 55.15% of all e-commerce stores use a .com domain. It remains the global “gold standard” for consumer trust and brand authority. But when we look at specific platforms, the “domain personality” starts to shift.

Shopify merchants are the ultimate .com loyalists, with 67.33% choosing the classic ending. They are also the primary drivers behind modern alternatives like .store (2.98%) and .shop (2.83%).

WooCommerce users take a different path. Only 49.14% use .com. Instead, they lean toward country-specific domains (like .de or .nl) and .org (2.19%). This confirms that WooCommerce is the go-to for local sellers and non-profits.

Key Takeaway: For a professional, global brand, .com is your best bet. Shopify is the leader for global and “shopping-themed” domains, while WooCommerce is favored by local businesses and non-profit organizations.

A Contact Page Is Now the Ultimate Trust Signal Appearing on 56.80% of 2026 Storefronts, as Shoppers Prioritize Direct Accessibility

Beyond aesthetics, the success of a 2026 storefront is measured by its utility. Our analysis of 13 million of stores reveals that functional tools—focused on communication and transparency—are the top priority for high-converting brands.

The Contact Page remains the single most essential feature, appearing on 56.80% of all e-commerce sites. In an era of automated bots, a clear “Contact Us” page is a major trust signal.

The Transparency Standard

Shoppers in 2026 expect “Amazon-level” visibility into their purchases:

- Order Tracking & Returns (24.35%): Nearly one-quarter of stores now bake tracking directly into their site. This reduces “Where is my order?” (WISMO) inquiries by up to 54%.

- FAQ Pages (13.84%): These aren’t just for support; they are conversion engines. By answering concerns about shipping and returns upfront, brands remove the final barriers to the “Buy” button.

Content as a Community Builder

Modern stores are moving away from being simple catalogs. They are becoming content hubs:

- CMS & Blogging (33.14%): One in three stores uses a Content Management System, with 17.13% maintaining a blog. This strategy focuses on SEO and building a community around the brand.

- Headless Commerce (2.06%): A growing niche for high-end brands. By separating the “head” (the visual design) from the “body” (the backend data), these stores achieve ultra-fast load times and total design freedom.

Key Takeaway: A “pretty” store is just the baseline. To stay competitive in 2026, you must invest in transparency tools. Making it easy for customers to find answers and track their journey is the fastest way to build lasting brand trust.

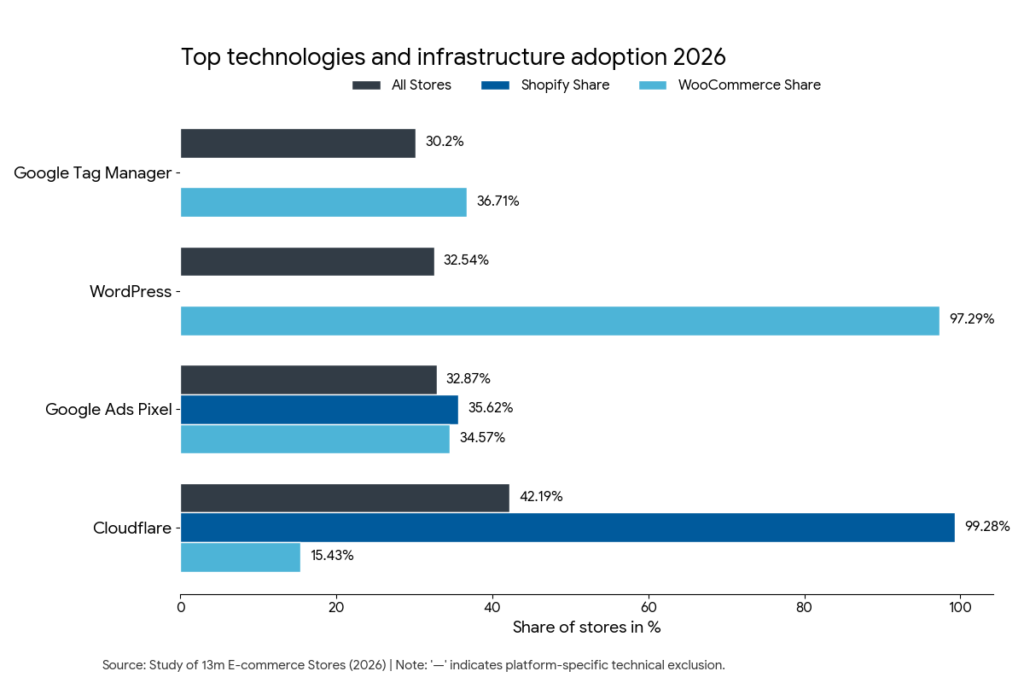

Cloudflare is the Leading Security/Performance Tool, used by 42.19% of Stores

How do stores stay fast and safe in 2026?

Most rely on the same industry giant: Cloudflare. It is the top security technology in our study, used by 42.19% of all e-commerce stores.

But the data reveals a massive technical split:

- Shopify is a “walled garden.” Over 99.28% of its stores use Cloudflare because it is built directly into the service.

- WooCommerce is an open-source powerhouse. 97.29% of its stores are built on WordPress, giving owners total control over their stack.

Growth tools also vary by platform. Shopify merchants prioritize “fast checkout” to reduce friction. Over 59% offer Apple Pay, and 53.29% use Shop Pay.

WooCommerce merchants focus on search visibility. 34.40% use the Yoast plugin to help their stores rank higher in Google results.

Key Takeaway: Shopify provides high-end security and fast payments automatically. WooCommerce offers more manual control, allowing you to build on WordPress and use specialized plugins like Yoast for search rankings.

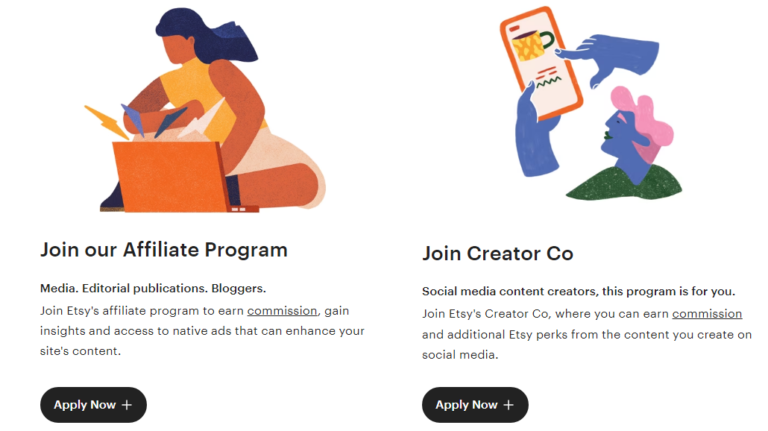

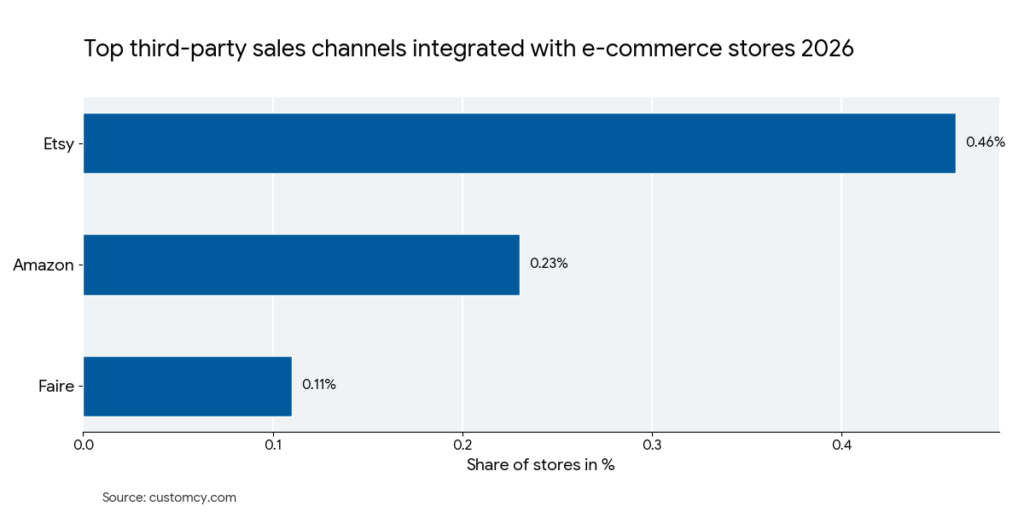

Etsy (63,413 Stores) and Amazon (31,614 Stores) Rank as the Most Popular Secondary Marketplaces Among Sellers, Based on Detected Multi-Channel Usage in Our Dataset

In 2026, smart store owners don’t just sell on their own websites. They also list their products on “secondary” marketplaces to find more customers. Our data shows that Etsy is the #1 choice for this, with 63,413 stores using it to reach people who love handmade and unique gifts.

In another report How Much Money Do Etsy Sellers Make in 2026? We found that Etsy sellers make $2,965 per month.

Amazon comes in second, with 31,614 stores using it to tap into the world’s biggest audience of fast shoppers. Newer platforms like Faire are also growing because they help small brands sell their products to local boutiques and gift shops. By selling in more than one place, these businesses make sure they are seen by as many people as possible.

Key Takeaway: Most online brands start on their own site but quickly expand to marketplaces to find new buyers. If you are a creator, Etsy is your home; if you are scaling a mass-market brand, Amazon is essential. Diversifying into wholesale platforms like Customcy is the next big step for brands looking to mature in 2026.

Over 5% of E-commerce Stores are Currently Password-Protected

The digital marketplace is currently a hive of activity. Our latest analysis reveals that 94.35% of all e-commerce stores are “Active,” meaning they are live, fully operational, and ready for customers to complete purchases. This high percentage illustrates the massive scale of the competitive landscape in 2026, where millions of brands are vying for consumer attention simultaneously across the globe.

However, the remaining 5.65% of stores are “Password Protected.” This status typically indicates a brand is in a strategic holding pattern. Many of these are in a “pre-launch” phase, where owners are fine-tuning their site’s design or inventory before a grand opening. Interestingly, a growing trend in high-end fashion and tech involves using password protection for “exclusive drops.” By restricting entry to VIPs or code-holders, brands can generate significant hype and artificial scarcity, turning a “closed” store into a powerful, high-conversion marketing event.

Key Takeaway: While the vast majority of the market is open for general business, password protection remains a vital strategic tool for stores in development or those focusing on high-demand exclusivity.

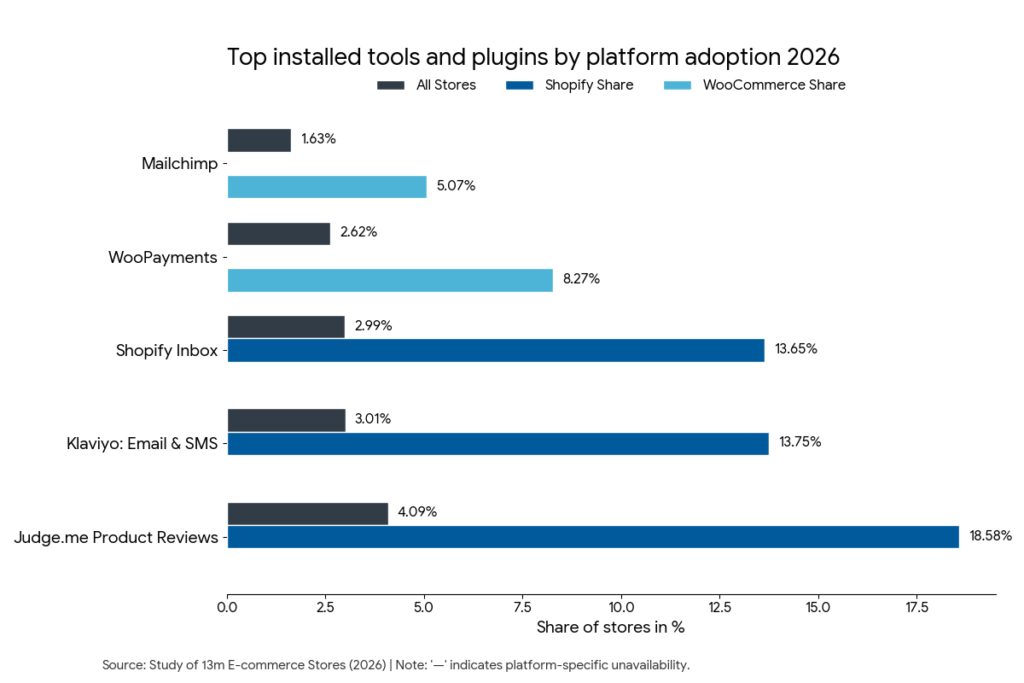

Judge.me dominates the Shopify App Store with an 18.58% usage rate, making it the #1 choice for building customer trust

What tools do the world’s most successful stores actually use?

We analyzed millions of shops to find the “must-have” apps for 2026. One name stood out: Judge.me. It is used by 4.09% of all e-commerce stores to build social proof through product reviews.

However, the data reveals a massive split in how merchants prioritize their tools:

- Shopify merchants are marketing-obsessed. 18.58% use Judge.me, and over 13% rely on Klaviyo for email marketing. They focus heavily on branding and customer feedback.

- WooCommerce merchants focus on the “engine.” Their #1 tool is WooPayments (8.27%), followed by Mailchimp (5.07%).

We also saw WooCommerce users installing specialized functional tools like Subscriptions (0.93%) and Bookings (0.32%). These are far less common in the Shopify ecosystem, showing that WooCommerce is the preferred choice for complex business models.

Key Takeaway: Shopify stores invest heavily in marketing and social proof apps to drive sales. WooCommerce users prioritize payment processing and specialized business functions like bookings or subscriptions.

USPS Is the Top Shipping Choice With a 3.71 Percent Market Share

How does your product get to your customer’s doorstep?

In the world of e-commerce, a few major names handle the heavy lifting. Our data confirms that USPS is the global leader, used by 3.71% of all online stores.

But your choice of platform often determines your delivery partner. Shopify merchants are huge fans of the postal service, with 7.81% using USPS—nearly four times the market average. This is likely because Shopify makes it incredibly easy to print labels and ship small packages directly.

WooCommerce users take a different path. They actually lean toward UPS (1.83%) slightly over USPS (1.65%). This suggests that WooCommerce sellers might handle heavier items or prefer the specific tracking features that UPS provides.

We also see local carriers like Royal Mail and Australia Post making a strong showing, proving that the final mile is always local.

Key Takeaway: USPS is the go-to for most online sellers, particularly on Shopify. However, WooCommerce users often prefer UPS. Both platforms offer strong connections to the world’s most trusted shipping names.

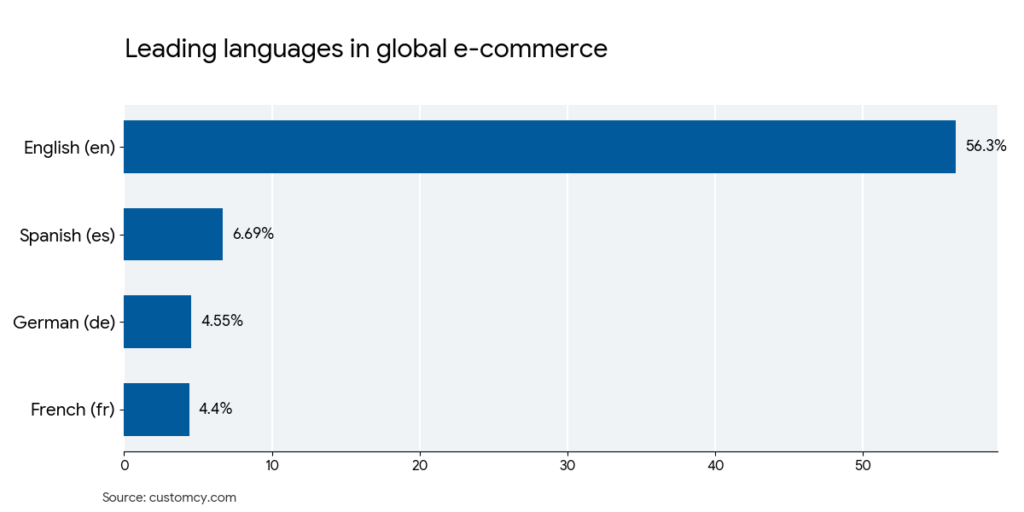

English Remains the Dominant Site Language, Used by 56.3% of Stores

How do you sell to a customer on the other side of the planet?

In 2026, the answer is still the same: English.

Our data shows that English (en) is the dominant language, used by 56.30% of all e-commerce stores worldwide. It acts as the primary bridge for global trade.

But English isn’t just for native speakers. Millions of international shoppers use it as a second language to browse and buy from global brands.

However, a “one-size-fits-all” approach is changing. We are seeing a massive surge in local languages:

- Spanish (6.69%) and Portuguese (3.52%) are exploding. This reflects the rapid growth of e-commerce in Latin America and Brazil.

- German and French remain powerhouses, anchoring the stable European market.

- Persian (1.47%) and Vietnamese (1.11%) are climbing the ranks. This proves that mobile shopping is booming in emerging markets.

Key Takeaway: English is your most essential tool for global reach. But if you want to tap into the world’s fastest-growing regional economies, you must localize for Spanish, Portuguese, and German shoppers.

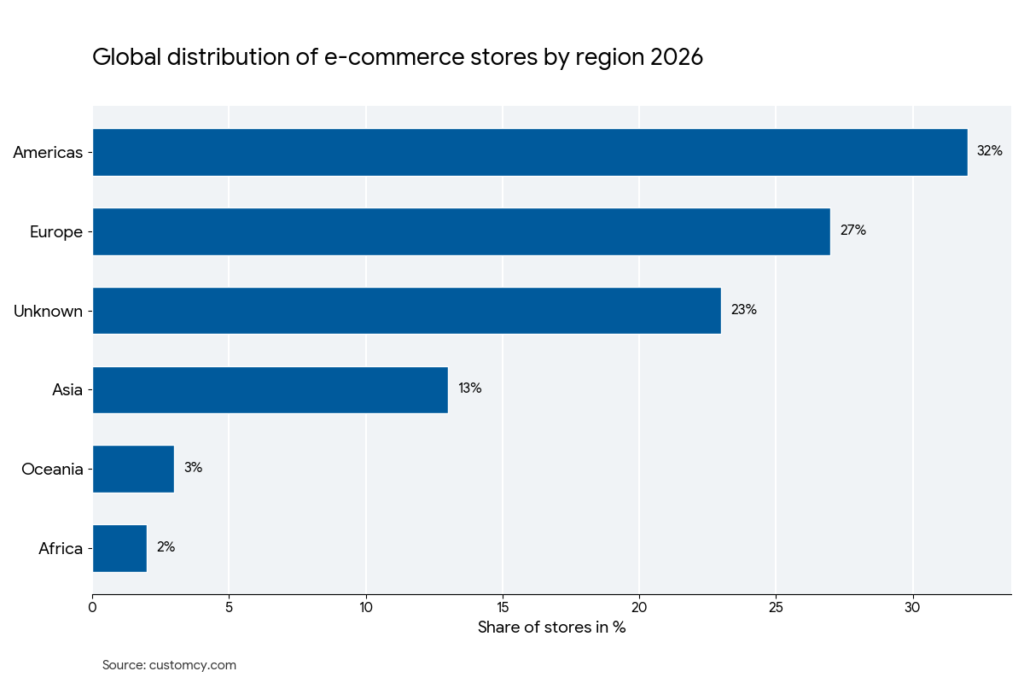

The Americas remain the global leader, holding 32% of all stores

Where is the digital economy anchored in 2026? Our unified data reveals a clear divide between established heavyweights and emerging engines of growth.

The Americas remain the global leader, holding 32% of all stores, with North America alone accounting for one out of every four online shops. Alongside Western Europe (10%), these “Western Strongholds” offer the highest consumer trust and advanced logistics, making them the safest bets for high-volume retailers.

However, the “Growth Corridors” are shifting. While Asia holds a 13% share, its sub-regions—specifically Southern Asia (5%) and Eastern Asia (4%)—are expanding faster than any other territory through mobile-first models.

Interestingly, 23% of stores are now “Cloud-Native,” operating without a fixed regional identity. These decentralized brands use global fulfillment to exist everywhere at once, reflecting a major shift in how modern companies define their physical presence.

Key Takeaway: For stability and high-order values, target North America and Western Europe. For “Blue Ocean” opportunities with rapid growth and less competition, Southern Asia and South America are the regions currently reshaping the global landscape.

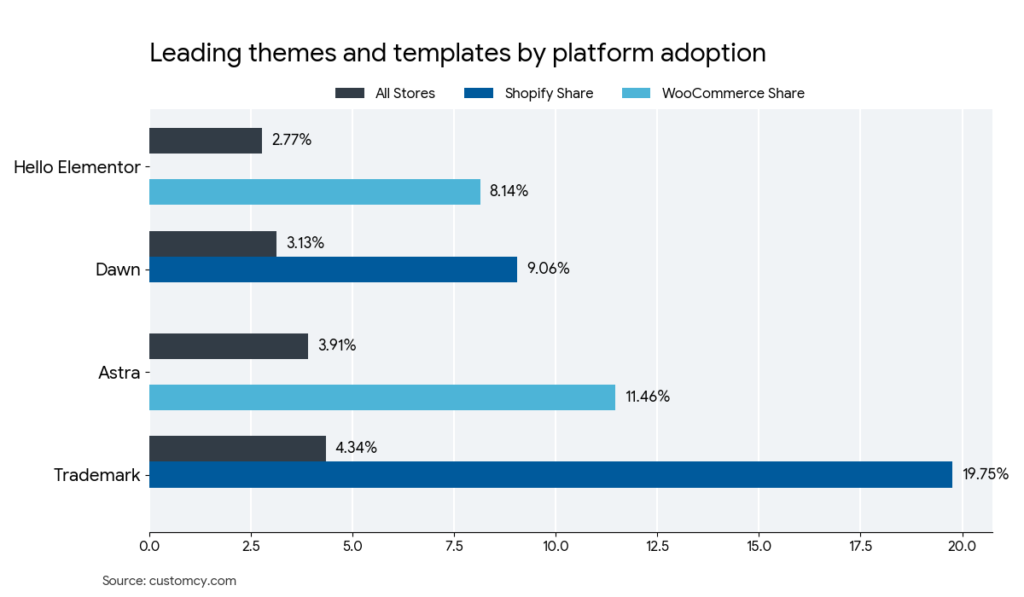

One in Five Shopify Merchants Uses the Trademark Theme (19.5%), Highlighting a Shift Toward Premium, Feature-Rich Storefronts

In 2026, first impressions are the primary driver of digital trust. Trademark leads the theme market with a 4.34% usage rate, favored by Shopify merchants (19.5%) for its polished, “out-of-the-box” look. While Shopify users lean toward clean designs like Dawn (9.06%), WooCommerce sellers prioritize the deep flexibility of Astra (11.46%) and Hello Elementor (8.14%).

However, the biggest trend isn’t a single theme—it’s originality. A staggering 79% of stores use “Unknown” or custom-coded designs to bypass standard templates. For those choosing a middle ground, premium vendors like Maestrooo (5%) and Archetype Themes (1%) offer a “luxury shortcut,” delivering high-conversion features like the popular Prestige and Impulse themes without the cost of a full custom build.

Key Takeaway: Use Shopify’s Trademark for speed and style, or WooCommerce’s Astra for pixel-perfect control. But to truly stand out, most global brands eventually invest in custom design.

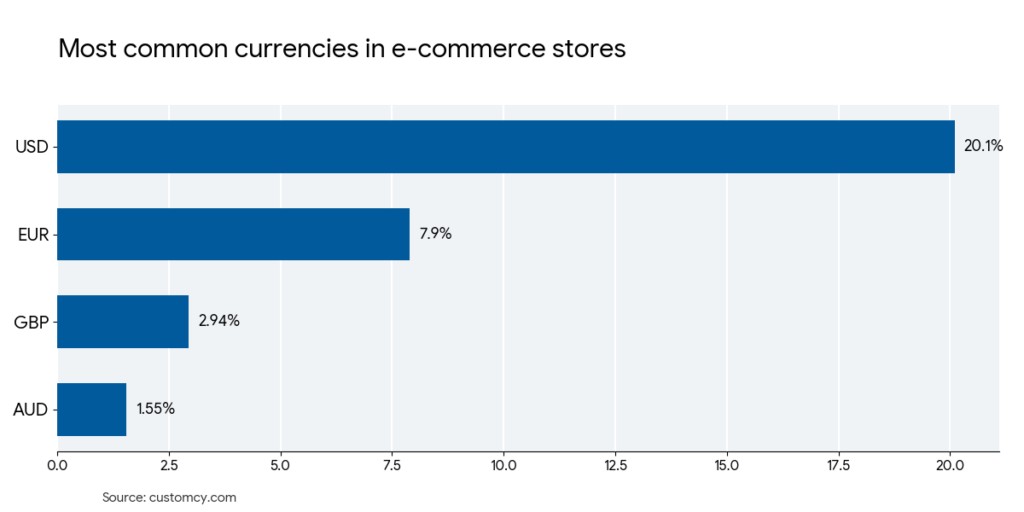

The US Dollar is the Leading Currency for E-commerce, With a 20.10 Percent Share

What is the official “language of money” in 2026?

The data points to one clear winner: the US Dollar (USD).

Our research shows that 20.10% of all e-commerce stores use USD. It remains the undisputed king of online trade. To put its dominance in perspective, the USD is used more than twice as often as the Euro (7.90%) and nearly seven times more than the British Pound (2.94%).

Key Takeaway: The US Dollar is still the gold standard for global stability.